This Notice of Annual Meeting of Stockholders and the Proxy Statement herein provide further information on the Company’s performance and corporate governance and describe the matters to be presented at the Annual Meeting. The Board set March 16, 2018 as the record date (the “Record Date”) for the Annual Meeting. Holders of record of our common stock at the close of business on the Record Date are entitled to receive this notice of, and vote at the Annual Meeting.

Beginning on or about March 23, 2018, we mailed an Important Notice Regarding the Availability of Proxy Materials (the “Notice”) to our holders of record. The Notice contained instructions on how to access the Proxy Statement and related materials on the Internet and how to enter your voting instructions. Instructions for requesting a paper copy of the proxy materials are contained in the Notice. A list of stockholders entitled to vote at the Annual Meeting will be available at our office at 200 North Canal Street, Natchez, MS 39120 during normal business hours for a period of ten days prior to the meeting and will also be available for inspection at the Annual Meeting.

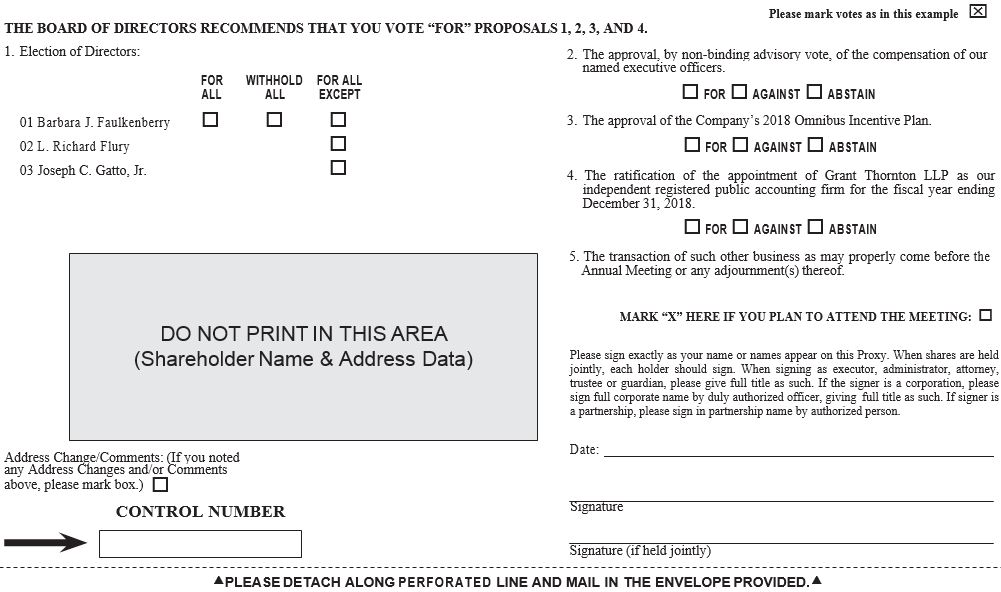

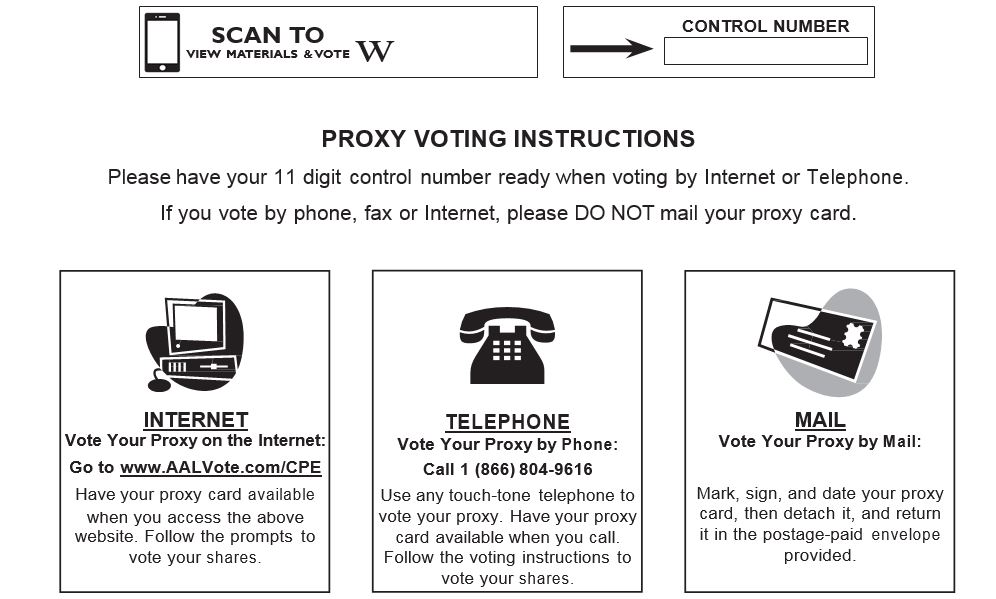

Whether or not you plan to attend the Annual Meeting, please vote electronically via the Internet or by telephone, or please complete, sign, date and return the accompanying proxy card as soon as possible. See “Annual Meeting Information” towards the end of this Proxy Statement for more details.

We thank you for your continued support and look forward to seeing you at the Annual Meeting.

|

| | |

Natchez, Mississippi | | By Order of the Board of Directors |

March 23, 2018 | | |

| | | |

| | | B.F. Weatherly |

| | Corporate Secretary |

YOUR VOTE IS IMPORTANT!

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on

May 10, 2018, at 9:00 a.m., Central Daylight Time:

This Proxy Statement and our 2017 Annual Report on Form 10-K are available at:

https://www.viewproxy.com/CallonPetroleum/2018 and www.callon.com

If you have any questions or need assistance voting your shares, please call our proxy solicitor:

Alliance Advisors

200 Broadacres Drive, 3rd Fl.

Bloomfield, NJ 07003

Banks and Brokerage Firms, please call: (973) 873-7700

Stockholders, please call toll free: (833) 786-5511

This summary is included to provide an introduction and overviewProposal 5:

To approve an amendment to our certificate of incorporation to permit us to effect a reverse stock split of our issued and outstanding common stock, par value $0.01 per share (the “common stock”), at a ratio that will be determined by the Board and that will be within a range of 1-for-10 and 1-for-50 (the “Reverse Stock Split”), if the Board determines, in its sole discretion, at any time prior to the first anniversary of the information contained in this Proxy Statement. This is a summary only and highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information you should consider and is not a form for voting. You should read the entire Proxy Statement carefully before voting. Additional information regarding our 2017 performance can be found in our Annual Report on Form 10-K.

|

| | |

Annual Meeting, that the Reverse Stock Split is in the best interests of Stockholdersthe Company and its shareholders. | | FOR |

| | | |

Date and Time | By Internet or telephone following the simple instructions on the enclosed proxy card or voting instruction form | |

| | May 10, 2018, at 9:00 a.m., Central Daylight Time |

Location | | Natchez Grand Hotel, 111 Broadway Street, Natchez, Mississippi 39120 |

Record Date | |

| | March 16, 2018 |

Proxy Voting | By mail mark, date and sign your proxy card, and return it in the reply envelope provided | | Shareholders as | |

| w | | | |

| Proposal 6:

To approve an amendment to our certificate of incorporation to reduce the closenumber of business on the record date are entitled to vote. Each shareauthorized shares of common stock is entitled to one vote by proxy or at the annual meetingreverse stock split ratio determined by the Board (the “Authorized Share Reduction”). |

FOR | | | | | | Items to be Voted on at | | | YOUR VOTE IS IMPORTANT! Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders. This Proxy Statement and our 2019 Annual Report on Form 10-K are available at: www.viewproxy.com/ CallonPetroleum/2020. If you have any questions or need assistance voting your shares, please call our proxy solicitor, Innisfree M&A Incorporated, 501 Madison Avenue, 20th Floor, New York, NY 10022 Banks and Brokerage Firms, please call: (212) 750-5833 Shareholders, please call toll-free:(888) 750-5834 | | | w | | | | | | | | | | Proposals | | Board Recommendations | 1. | | Election of directors | | FOR each nominee | 2. | | Advisory vote to approve NEO compensation | | FOR | 3. | | Approval of the 2018 Plan

| | FOR | 4. | | Ratification of the appointment of independent registered public accounting firm | | FOR |

2017 Performance Highlights4 CALLON PETROLEUM

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

| | | | | | | | | | | We will also transact other business that may properly come before the Annual Meeting. This Notice of Annual Meeting of Shareholders and the Proxy Statement herein provide further information on the Company’s performance and corporate governance and describe the matters to be presented at the Annual Meeting. The Board set April 14, 2020, as the record date (the “Record Date”) for the Annual Meeting. Holders of record of our common stock at the close of business on the Record Date are entitled to receive this notice of, and vote at, the Annual Meeting. A list of the names of shareholders entitled to vote at the Annual Meeting will be available for ten days prior to the Annual Meeting for examination by any shareholder for any purpose germane to the Annual Meeting between the hours of 9:00 a.m. and 5:00 p.m., Central Time, at our headquarters at 2000 W. Sam Houston Parkway South, Suite 2000, Houston, TX 77042. This list will also be available for such purposes during the Annual Meeting at the place of the Annual Meeting or, in the event that the Annual Meeting is held virtually, at a website to be provided in the announcement notifying shareholders of the change in meeting format. Beginning on or about [•], 2020, we mailed an Important Notice Regarding the Availability of Proxy Materials (the “Notice”) to our holders of record. The Notice contained instructions on how to access the Proxy Statement and related materials on the Internet and how to enter your voting instructions. Instructions for requesting a paper copy of the proxy materials are contained in the Notice. We thank you for your continued support and look forward to seeing you at the Annual Meeting. By Order of the Board of Directors, | | | | | | | | | | Michol L. Ecklund

Senior Vice President, General Counsel

and Corporate Secretary

Houston, Texas

[•], 2020 | | |

TABLE OF CONTENTS

PERFORMANCE HIGHLIGHTS Callon is an independent oil and natural gas company focused on the acquisition, exploration, and development of high-quality assets in leading Texas oil plays located in the Permian Basin and the Eagle Ford Shale. Callon’s strong foundation spans over 70 years with an ongoing mission to build trust, create long-term value, and drive sustainable cash flow growth for our stakeholders. We are positioned to deliver value for our stakeholders in 2020 and beyond through the following: | | | | | | | PREPARATION | | PURPOSE | | EXECUTION OF PURPOSE | • Significant scale and high operational control of ~200,000 net acres in Texas's producer-friendly Permian Basin and Eagle Ford Shale • Robust infrastructure network from multiple years of thoughtful planning and investment reduces overall capital intensity • Liquidity flexibility and free cash flow initiatives support long-term co-development for inventory and balance sheet preservation • Talented workforce with growing technical expertise identifies with a culture of responsibility and adaptability in a cyclical commodity business | | • Long-term value creation focuses on growing corporate level returns through capital efficiency and reserve recovery optimization • Sustainable business model balances capital efficiency improvements with longer-term reinvestment reduction initiatives • Stakeholder alignment through governance structure and ongoing engagement across shareholders, employees, and communities in which we operate • Expanding ESG oversight to maximize impact of initiatives and ensure corporate responsibility priorities are achieved | | • Accelerate corporate returns on capital through margin preservation, capital intensity reduction, and portfolio optimization • Generate meaningful free cash flow through breakeven cost reduction and moderation of production declines • Improve financial profile with simplified capital structure and no near-term maturities with asset monetization upside • Long term vision focused on safety and sustainability to maximize reserve capture through prudent co-development operations |

2019 was a transformational year of transition, growth and solid results for Callon. In May 2017, we unexpectedly lost our long-time Board ChairmanThe Company continued its long-term value creation focus with the execution of multiple strategic initiatives across operations, finance, environmental, social and Chief Executive Officer (“CEO”), Fred Callon,governance. The Company’s development program successfully transitioned to larger projects featuring multi-zone co-development, leading to improved capital efficiency, lower costs and the preservation of industry-leading margins. The year culminated with the successful closing of the Carrizo Acquisition, which led to several changes on our leadership team. Even with these transitions,more than doubled the company achieved strong results as we continued to growCompany’s production, reserves, acreage, and cash margins againstflow. The combined Company features a diversified asset base that supports our scaled development model and provides significant optionality to support cash generation amid commodity price volatility. While Callon’s share price was negatively impacted, along with its industry peers, by commodity price volatility and a shift in sector-wide investor sentiment, the backdropCompany maintained its commitment to long-term value creation in 2019 as reflected by the achievement of an improving, but tenuous commodity environment. Importantly, we successfully integrated over 40,000 net acres in the Midlandmultiple key operational, financial and Delaware Basins that were acquired over the last two years, ensuring that these investments had a near-term impact on stockholder value in 2017. Other key accomplishments included the following:ESG highlights as described below.

Increased daily production approximately 50% year over year to 22,940 barrels of oil equivalent per day (“Boepd”), with a sustained oil content of nearly 80%;

Achieved three-year compounded annual production growth rate of 60%;2020 PROXY STATEMENT7

Increased estimated net proved reserves nearly 50% year over year to 137 million barrels of oil equivalent (“MMBoe”), with 51% classified as proved developed producing;PERFORMANCE HIGHLIGHTS

Replaced 2017 production by 642%;

Increased corporate cash margins by 34% to $25.05 per barrels of oil equivalent (“Boe”) despite an inflationary service cost environment and substantial growth in employee count to execute our growth strategy;Decreased lease operating expense (“LOE”) per Boe by 13% and general and administrative expense (“G&A”) per Boe by 32% year over year;

Improved our “drill bit” finding and development (“F&D”) costs to $8.21 per Boe despite an inflationary service cost environment;

EBITDA margins continued to be amongst highest within our Permian peer group;

Closed on our acquisition of over 16,000 net acres in the Delaware Basin, establishing our new Spur operating area as a beachhead for future growth;

Subsequently acquired 2,488 contiguous net acres within our footprint during the year;

Achieved a 65% decrease in water spills and 50% decrease in oil spills per MMBO vs 2016;

Nearly doubled participation in our proactive safety observation card program (Callon and contractors) compared to 2016, with ~4,500 cards submitted; | | | • With the closing of the Carrizo Acquisition, more than doubled our acreage position to nearly 200,000 net acres in Texas's producer-friendly Permian Basin and Eagle Ford Shale. | • Generated over $500 million in Adjusted EBITDA(i). | • Completed over $300 million of non-core asset monetizations. | • Redeemed approximately $270 million of preferred securities resulting in prospective dividend savings of nearly $25 million annually. | • Generated $58.2 million in free cash flow(ii) during the fourth quarter of 2019 (on a pro forma basis). | • Maintained an industry leading EBITDA margin of $33.28 per Boe for 2019.(i) | • Achieved record production (top of guidance) with operational capital spending below the bottom of full year guidance range. | • Initiated full-field co-development across all asset areas, lowering target development costs and improving capital efficiency. | • Grew total proved reserves to 540 MMBoe with a PV-10(i) value of $5.4 billion as of December 31, 2019. | • Achieved record safety performance metrics, including a Total Recordable Incident Rate that was 50% lower than prior year. | •2x recycled water volumes from 2018, further reducing environmental impact of operations. | • Reduced flaring by more than 40% year over year and was in the lowest third of all Texas producers in flaring intensity per the most recent TX RRC report.(iii) |

| | •(i) | See Appendix A for a reconciliation of Non-GAAP financial measures |

| | (ii) | Free cash flow is defined as Adjusted EBITDA minus the sum of operational capital, capitalized interest, capitalized G&A, and interest expense. Adjusted EBITDA is a Non-GAAP financial measure; please refer to Appendix A for a reconciliation |

| | (ii) | TX RRC defines flare intensity as gross daily flare volumes divided by gross daily oil production |

Coming off a strong 2019, Callon remains driven by a long-term value focus, and our progress in maturing our operations and production base in recent years now allows us to drive continued improvements in our cash flow profile and corporate-level returns. In 2020 and beyond, the Company is well-positioned to progress efficiencies in our development program through larger pad developments, reduced leasehold obligations and leveraging of established infrastructure for the benefit of our shareholders.

SUSTAINABILITY AT

CALLON PETROLEUM At Callon, our commitment to our shareholders is simple: create value in a responsible manner. Our focus on integrating sustainable business practices and achieving long-term results drives our operations. In alignment with these goals, our Board of Directors oversees the company’s safety and environmental policies, development of a positive corporate culture and an effective corporate governance program. To ensure that sustainability matters remain a priority at Callon, the independent Nominating and Corporate Governance Committee of our Board has direct oversight responsibility for our ESG policies and performance for the development of Company positions related to stakeholder concerns and emerging issues that affect our industry. The entire Callon team is committed to improving returns for our shareholders while positively impacting the communities in which we live and work. Our corporate focus is anchored by five core values: Responsibility, Integrity, Drive, Respect and Excellence. Environmental Callon is committed to safeguarding the environment and conducting our business in a manner designed to comply with applicable environmental laws and regulations and apply responsible standards where such laws or regulations do not exist. We have adopted a Safety and Environmental Policy that sets forth our operating principles and our expectations of Callon employees and contractors to operate safely, responsibly and in an environmentally sound manner. | | | | | | | | | | | | | WATER | | | AIR | | | LAND | | Protecting local water supplies and minimizing our use of fresh water resources are high priorities in our operations. | | As part of our environmental program, Callon monitors and seeks to reduce greenhouse gas (GHG) and other emissions from our operations. | | At Callon, we strive to be good stewards of the environment and minimize our impact in the areas where we operate. | | | | | | | | | | | | 2x recycled water volumes from 2018, further reducing environmental impact from operations | | All of the drilling rigs operating on Callon assets are dual-fuel rigs, which reduce greenhouse gas emissions in our operations. | | ReducedDecreased total fluid spill rate by ~50%

| | | | | | | | | | | | <20% permitted water infrastructure utilization rate in Permian Basin minimizes future environmental impact | | Eliminated diesel-powered generators as a primary source of power and in doing so lowered our Debt/Last Three Quarters Annualized (“LTQA”) EBITDA ratioemissions and operating costs. | | >2x increase in average project size in 2020 minimizes surface impact | | | | | | | | | | | | 60% produced water sourced for Delaware completions | | >40% reduction in gas flaring intensity(i)(1) | | to 2.2x (1.8x on a Debt/Last Quarter Annualized (“LQA”) basis>90% (i));of crude and water transported via pipeline

|

| | (1) | Based on flaring intensity MCF/Bbl as defined by the Texas Railroad Commission (TX RRC). TX RRC defines flare intensity as gross daily flare volumes divided by gross daily oil production. |

Issued Senior NotesSocial

Callon values the perspectives of all stakeholders including employees, contractors, local communities and shareholders. We are focused on protecting, empowering and developing our team members and contributing meaningfully to the communities where we live and work. For us, corporate stewardship is not just a financial obligation, but a social duty as well.

SUSTAINABILITY AT CALLON PETROLEUM

| | | | | | | | | | | | | | | Safety | | 50% reduction in Total Recordable Incident Rate (TRIR) (2019 best year on record for safety performance) | | | At Callon, protecting our people and our communities is our top priority. We believe that a strong safety culture is tantamount to being a leading operator in the exploration and production (E&P) business. | | | | | | | |

| | | | | | | | | | | | | | | Workforce | | | | | BUILDING A TOP PLACE TO WORK | | | | | At Callon, a goal is to assemble and inspire a team of passionate and innovative professionals in an environment where they can achieve their professional goals. We empower our employees and engage team members in decision-making at every level while recognizing contributions to our success. This unique environment has helped us achieve top-tier engagement scores, resulting in Callon being named a Top Workplace by Houston Chronicle in 2017 (small company), 2018 (mid-size company), and 2019 (mid-size company). | | | | | | | | | | | | | | | | EMBRACING DIVERSE BACKGROUNDS AND PERSPECTIVES | | | | | At Callon, we value the diversity of our employees and their contributions. We are firmly committed to fostering an inclusive environment and providing equal opportunity to all qualified persons. | | MINORITY EMPLOYEES IN 2020 | | | | | | | | | | | | | |

| | | | | | | | | | | | | Community | | | | OPERATING IN LOCAL COMMUNITIES | SUPPORTING LOCAL COMMUNITIES | | | When our assets necessitate development projects near populated areas, we make every effort to mitigate the impact of our activities and work closely with city officials and neighboring landowners to proactively address considerations such as: noise, traffic, greenhouse gas emissions, and liquid spill prevention | Callon has a longstanding history of supporting the local communities in which we operate. It is our privilege to make a positive impact through charitable giving and volunteerism to support key initiatives to support education, community, and the environment. We also sponsor a charitable matching program to support our employees’ philanthropic priorities. | | | | | | |

Governance | | | | At Callon, we are committed to high ethical standards and effective and sustainable corporate governance. We believe this commitment promotes the long-term interests of our shareholders, helps build public trust in our Company and strengthens Board and management accountability. We continually assess our governance principles to ensure that we are operating our business responsibly, ethically and in a manner aligned with the interests of our shareholders. Our CD&A beginning on page 36 provides additional information on governance practices for executive compensation. | Our Board expanded the scope of our independent Nominating & Corporate Governance committee to enhance oversight of the Company’s ESG policies, performance and disclosure. |

| | | | | | | | | | | | Two female directors | Less than five year tenure for over half the directors | Independent, non-executive director serves as chair of the Board | | | | | | |

| | | | | | | Proposal 1 Election of

Class II

Directors | | The Board of Directors recommends a vote FOR each of the Class II director nominees named in this Proxy Statement. • Our director nominees provide experience and perspectives that enhance the overall strategic and oversight functions of Callon’s Board. • For more information about the nominees’ experience, skills, and qualifications, please see page 13. | | | |

Board of Directors Process for Selecting Directors Director Identification and Selection Criteria. The Nominating and Corporate Governance Committee has established guidelines for considering nominations to the Board. The Committee evaluates potential nominees based on the contribution such nominee’s background and skills could have upon achieving the goal of a well-rounded, diverse Board that functions collegially as a unit. While not an exhaustive list, key criteria include: Relevant oil and gas exploration and production industry knowledge and experience; Complimentary mix of backgrounds and experience in areas including business, finance, accounting, technology, and strategy; Personal qualities of leadership, character, judgment and personal and professional integrity and high ethical standards; The candidate’s ability to exercise independent and informed business judgment; Whether the candidate is free of conflicts and has the time required for preparation, participation, and attendance at meetings; Diversity, including differences in viewpoints, background, education, gender, race or ethnicity, age, and other individual qualifications and attributes; The ability to work with other members of the Board, the Chief Executive Officer (the "CEO"), and senior officers of the Company in a constructive and collaborative fashion to achieve the Company’s goals and implement its strategy; and In the case of an effective yieldincumbent director, such director’s past performance on the Board. The Nominating and Corporate Governance Committee and the Board may also consider other qualifications and attributes that they believe are appropriate in evaluating the ability of 5.2%, contributingan individual to serve as a member of the Board. The Nominating and Corporate Governance Committee’s goal is to assemble a Board that brings to us a variety of perspectives and skills derived from high quality business and professional experience to perform its oversight role satisfactorily for our shareholders. In making its determinations, the Committee evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best represent shareholder interests through the active, objective, and constructive participation in meetings and the strategic decision-making processes. Diversity. Our Corporate Governance Guidelines set forth our policy with respect to Board diversity. We are committed to building a diverse Board comprised of individuals from different backgrounds, including differences in viewpoints, education, gender, race or ethnicity, age, and other individual qualifications and attributes. To accomplish this, the Nominating and Corporate Governance Committee will continue to require that search firms engaged by the Company seek to present a robust selection of women and ethnically diverse candidates in all prospective director candidate pools. Nominating Process. In making its nominations, the Nominating and Corporate Governance Committee identifies nominees by first evaluating the current members of the Board willing to continue their service and any potential need to expand the Board to include additional expertise. Current members with a record of quality contribution to the Board whose experience contributes to a improved costcomplementary mix of capital;backgrounds that enhance the Board are renominated. When vacancies become available, the Committee may seek input from industry experts or engage third-party search firms to help source particular areas of expertise or backgrounds. Increased liquidity

Over time, the Board refreshes its membership through a combination of adding or replacing directors to achieve the appropriate balance between maintaining longer-term directors with deep institutional knowledge of the Company and adding directors who bring a diversity of perspectives and experience. As a reflection of this philosophy, if all of the nominees are elected to the Board, following the Annual Meeting: | | | | | | | 6/11 directors will have tenures of five or fewer years. | | | 10/11 directors will be independent. |

Majority Vote Standard Our Corporate Governance Guidelines provide for a majority voting policy in uncontested director elections. The Company believes that the majority vote standard ensures accountability and the opportunity for a positive mandate from the Company’s shareholders. At any shareholder meeting for the election of directors at which a quorum is present, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (“Majority Withheld Vote”) shall tender his or her resignation for consideration by increasing the borrowing baseNominating and Corporate Governance Committee following certification of the shareholder vote, unless the number of nominees exceeds the number of directors to $700 millionbe elected as of the Record Date for such meeting, in which event the directors shall be elected by a plurality of the votes cast. Such resignation will only be effective upon Board acceptance of such resignation after receiving the recommendation of the Nominating and Corporate Governance Committee. If a director nominee receives a Majority Withheld Vote, then promptly following the certification of the election results, the Nominating and Corporate Governance Committee will consider any factors it deems relevant to the best interests of the Company and our shareholders in determining whether to accept the director’s resignation and recommend to the Board that action to be taken with respect to the tendered resignation. Within 120 days following certification of the shareholder vote, the Board shall consider the recommendation and make a determination as to whether to accept or reject such director’s resignation and shall notify the director concerned of its decision. We will also added four lending institutionspromptly publicly disclose the Board’s decision and process in a periodic or current report filed with or furnished to our bank group.the SEC. If you hold your shares through a broker and you do not instruct the broker how to vote, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will have no effect upon the outcome of the vote. All shares of common stock represented by proxies will be voted “FOR” the election of the director nominees, except where authority to vote in the election of directors has been withheld. Should the nominees become unable or unwilling to serve as a director at the time of the Annual Meeting, the person or persons exercising the proxies will vote for the election of substitute nominees designated by the Board, or the Board may choose to reduce the number of members of the Board to be elected at the Annual Meeting in order to eliminate the vacancy. Your proxy cannot be otherwise voted for a person who is not named in this Proxy Statement as a candidate for director or for a greater number of persons than the number of director nominees named. The Board has no reason to believe that the nominees will be unable or unwilling to serve if elected. | | | The Board recommends a vote FOR each of the three Class II director nominees. | |

Directors Nominated For Re-Election The Board currently consists of eleven directors. Consistent with our certificate of incorporation, the current Board is divided into three classes designated as Class I, Class II, and Class III, each with staggered, three-year terms. Based on the recommendations from the Nominating and Corporate Governance Committee, the Board has nominated three continuing Class II Directors, Messrs. Matthew R. Bob, Anthony J. Nocchiero and James M. Trimble, to stand for re-election or, in each case, until the election and qualification of their respective successors or until their earlier death, retirement, resignation or removal. The following biographies reflect the particular experience, qualifications, attributes, and skills that led the Board to conclude that each nominee should stand for re-election to serve on the Board: Class II Directors | | | | (i)See Appendix B for | | Matthew R. Bob | | President of Eagle Oil and Gas; Managing Member of MB Exploration | | Matthew Bob has served as a reconciliationmember of Non-GAAP financial measures.the Board since 2014. Mr. Bob currently serves as President of Eagle Oil and Gas and has been the founder and managing member of MB Exploration and affiliated companies since 1994. Previously, Mr. Bob served as President of Hall Phoenix Energy LLC, a privately held oil and gas exploration company, from 2009 to 2011. Prior to forming MB Exploration, Mr. Bob was Chief Geophysicist at Pitts Oil Company. He began his career at Union Oil Company of California where he held various geological positions. Mr. Bob currently serves as an independent director of Southcross Energy, a natural gas processing and transportation company with operations in South Texas. Mr. Bob holds a B.A. in Geology from St. Louis University and an M.S. in Geology from Memphis University, and is a graduate of Harvard University’s Executive Management Program. He is a member of the American Association of Petroleum Geologists, the Society of Exploration Geophysicists and the Dallas Petroleum Club, and is a registered Geoscientist in the States of Texas, Mississippi and Louisiana. SKILLS AND QUALIFICATIONS: Mr. Bob’s extensive knowledge of the exploration and production industry and technical expertise are assets to the Board and qualify him as a director. His experience as a senior executive further strengthens the strategic and oversight functions of the Board. | INDEPENDENT Age 63 | 3Director Since 2014 Callon Committees:

Compensation (Chairman), Nominating and Corporate Governance, Strategic Planning and Reserves Other Current Directorships:

Southcross Energy | |

| | | | | | Anthony J. Nocchiero | | Former SVP and Chief Financial Officer (Retired) of CF Industries, Inc. | | Anthony Nocchiero has served as a member of the Board since 2011. Mr. Nocchiero retired as Senior Vice President and Chief Financial Officer for CF Industries, Inc. in 2010, a position he had held since 2007. From 2005 to 2007, he was the Vice President and Chief Financial Officer for Merisant Worldwide, Inc. Prior to that, Mr. Nocchiero was self-employed as an advisor and private consultant from 2002 to 2005. From 1999 to 2001, Mr. Nocchiero served as Vice President and CFO of BP Chemicals, the global petrochemical business of BP plc. Prior to that, he spent 24 years with Amoco Corporation in various financial and management positions, including service as Amoco’s Vice President and Controller from 1998 to 1999. Mr. Nocchiero has previous experience serving as a board member of various public and private companies, including Terra Nitrogen LP, Keytrade AG, Vysis Corporation and the Chicago Chamber of Commerce. Mr. Nocchiero holds a B.S. degree in Chemical Engineering from Washington University in St. Louis and an M.B.A. degree from the Kellogg Graduate School of Management at Northwestern University. SKILLS AND QUALIFICATIONS: Mr. Nocchiero’s broad financial, accounting and operating experience within the energy industry are valuable to the Board and make him a meaningful contributor as a director. Additionally, Mr. Nocchiero’s status as a “financial expert” and knowledge of public company reporting requirements add meaningful insights to the Board and Audit Committee. | INDEPENDENT Age 69 Director Since 2011 Callon Committees:

Audit (Chairman), Compensation, Strategic Planning and Reserves | |

| | | | | | James M. Trimble | | Former Chief Executive Officer and President (Retired) of Stone Energy Corporation | | James Trimble has served as a member of the Board since 2014. Most recently, Mr. Trimble served as the interim Chief Executive Officer and President of Stone Energy Corporation from 2017 to 2018. Prior to that, Mr. Trimble served as CEO and President of PDC Energy, Inc. from 2011 until his retirement in 2015. Mr. Trimble was Managing Director of Grand Gulf Energy Limited, a public company traded on the Australian Securities Exchange, and President and CEO of Grand Gulf’s U.S. subsidiary Grand Gulf Energy Company LLC, an exploration and development company focused primarily on drilling in mature basins in Texas, Louisiana and Oklahoma, from 2005 to 2010. Earlier in his career, Mr. Trimble was CEO of TexCal (formerly Tri-Union Development) and CEO of Elysium Energy, a privately held oil and gas exploration company. Prior to that, he was Senior Vice President of Exploration and Production for Cabot Oil and Gas, a publicly-traded independent energy company. Mr. Trimble currently serves as a director of Talos Energy, a publicly-traded oil and gas exploration company, and Chairman of the Board of Crestone Peak Resources LLC, a privately held oil and gas exploration company. Previously, Mr. Trimble was a director of Stone Energy Corporation from 2017 to 2018, PDC Energy from 2009 to 2016, C&J Energy Services from 2016 to 2017, Seisgen Exploration from 2008 to 2015, Grand Gulf Energy from 2009 to 2012, and Blue Dolphin Energy from 2002 to 2006. Mr. Trimble was an officer of PDC Energy in September 2013, when each of the twelve partnerships for which the company was the managing general partner filed for bankruptcy in the federal bankruptcy court, Northern District of Texas, Dallas Division and was on the board of C&J Energy Services when it filed for bankruptcy in the court of the Southern District of Texas, Houston Division in July 2016. Mr. Trimble graduated from Mississippi State University where he majored in petroleum engineering for undergraduate (Bachelor of Science) and graduate studies. He is a Registered Professional Engineer in the State of Texas. SKILLS AND QUALIFICATIONS: Mr. Trimble’s deep knowledge of the exploration and production industry and his leadership experience at previous companies strengthen the strategic and oversight functions of the Board. His experience on the boards of several other public companies provide valuable perspective on best practices relating to corporate governance, management and strategic transactions. | INDEPENDENT Age 71 Director Since 2014 Callon Committees:

Nominating and Corporate Governance (Chairman), Compensation, Strategic Planning and Reserves Other Current Directorships:

Talos Energy | |

Executive Compensation HighlightsCORPORATE GOVERNANCE

Directors Continuing in Office Biographical information for our directors continuing in office is set forth below. These individuals are not standing for re-election at this time: Class I Directors | | | | | | Michael L. Finch | | Former Chief Financial Officer (Retired) of Stone Energy Corporation | | Michael Finch has served as a member of the Board since 2015. He spent nearly 20 years affiliated with Stone Energy Corporation, a publicly-traded oil and gas exploration company, from which he retired as Chief Financial Officer and a member of the Board of Directors in 1999. Prior to his service with Stone Energy, he was employed by Arthur Andersen & Co. Mr. Finch was an independent director of Petroquest Energy, Inc. a publicly-traded oil and gas company, from 2003 to 2016, where he served as chairman of the Audit Committee and as a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Finch currently serves on the advisory board of C.H. Fenstermaker & Associates, a multi-disciplinary consulting firm that specializes in surveying and mapping, engineering and environmental consulting. Mr. Finch holds a B.S. in Accounting from the University of South Alabama and was licensed as a Certified Public Accountant (currently inactive). SKILLS AND QUALIFICATIONS: Mr. Finch’s extensive financial, accounting, and operating experience within the oil and gas industry are extremely valuable to the Board and qualify him as a director. In particular, Mr. Finch’s accounting background and status as a “financial expert” provide the Board valuable perspective on issues facing audit committees. | INDEPENDENT Age 64 Director Since 2015 Callon Committees:

Audit, Compensation, Strategic Planning and Reserves | |

| | | | | | S. P. Johnson IV | | Former President, Chief Executive Officer and Co-Founder (Retired) of Carrizo Oil & Gas, Inc. | | Mr. Johnson was a co-founder of Carrizo and served as the President and Chief Executive Officer and as a director from December 1993 to December 2019, when Carrizo merged with the Company. Prior to that, he worked for Shell Oil Company for 15 years, where his managerial positions included Operations Superintendent, Manager of Planning and Finance and Manager of Development Engineering. Mr. Johnson was also a director of Basic Energy Services, Inc., an oilfield service provider, and served as a director of Pinnacle Gas Resources, Inc., a coalbed methane exploration and production company, from 2003 to 2011. Mr. Johnson is a Registered Petroleum Engineer and holds a B.S. in Mechanical Engineering from the University of Colorado. SKILLS AND QUALIFICATIONS: Mr. Johnson brings to the Board extensive experience in oil and gas exploration and production and the energy industry through his roles at Carrizo and other energy companies. | INDEPENDENT Age 64 Director Since 2019 Callon Committees:

Strategic Planning and Reserves | |

Our

2020 PROXY STATEMENT15

| | | | | | Larry D. McVay | | Managing Director of Edgewater Energy, LLC | | Larry McVay has served as a member of the Board since 2007. Mr. McVay has been a Managing Director of Edgewater Energy, LLC, a privately held oil and gas investment company, since 2007. From 2003-2006, he served as Chief Operating Officer of TNK-BP Holding, one of the largest oil producing companies in Russia. From 2000-2003, he served as Technology Vice President and Vice President of Health, Safety and Environment for BP plc. Prior to joining BP, Mr. McVay held numerous positions at Amoco, including engineering management and senior operating leadership positions. Mr. McVay is a director of Linde plc, a publicly-traded industrial gas and engineering company. Previously, Mr. McVay was a director of Praxair, Inc., an industrial gases company in North and South America, until Praxair, Inc. and Linde AG combined to create Linde plc in 2018. Additionally, Mr. McVay was previously a director of Chicago Bridge and Iron Company, N.V., a publicly-traded engineering, procurement and construction company, until it merged into McDermott International in 2018. Mr. McVay earned a B.S. in Mechanical Engineering from Texas Tech University, where he was recognized as a Distinguished Engineer in 1995. SKILLS AND QUALIFICATIONS: Mr. McVay has been directly involved in nearly all aspects of the oil and gas industry, including drilling, production, finance, environmental, risk, and safety. We believe that this experience and his knowledge of the exploration and production industry, particularly in the Permian Basin, as well as his senior executive experience, service on other boards, and independence, provide valuable insight in the development of our long-term strategies and qualify him for service on the Board. | INDEPENDENT Age 72 Director Since 2007 Callon Committees:

Strategic Planning and Reserves (Chairman), Audit, Nominating and Corporate Governance Other Current Directorships:

Linde plc | |

| | | | | | Steven A. Webster | | Former Chairman of the Board and Co-Founder of Carrizo Oil & Gas, Inc. | | Mr. Webster was a co-founder of Carrizo for which he served as a director since 1993 and as its Chairman of the Board since 1997 until December 2019, when Carrizo merged with the Company. Since 2016, Mr. Webster has served as Managing Partner of AEC Partners, a private equity firm engaged in energy investment which was the successor to Avista Capital Partners, a private equity firm he co-founded in 2005 and for which he served as Co-Managing Partner. From 2000 through 2005, Mr. Webster served as Chairman of Global Energy Partners, an affiliate of DLJ Merchant Banking and CSFB Private Equity. From 1988 through 1999, Mr. Webster was the CEO and President of R&B Falcon Corporation and Chairman and CEO of one of its predecessor companies, Falcon Drilling Company, which he founded. Mr. Webster has been a founder or seed investor in numerous other private and public companies. He has held numerous board positions and currently serves as a director of ERA Group, Oceaneering International and various private companies. Since its founding in 1993, Mr. Webster has served as a Trust Manager of Camden Property Trust, a REIT. Mr. Webster holds an M.B.A. from Harvard Business School where he was a Baker Scholar. He also holds a B.S. in Industrial Management and an Honorary Doctorate in Management from Purdue University. SKILLS AND QUALIFICATIONS: Mr. Webster brings to the Board experience in, and knowledge of, the energy industry, business leadership skills from his tenure as chief executive officer of publicly traded companies and his over 30-year career in private equity and investment activities, and experience as a director of several other public and private companies. | INDEPENDENT Age 68 Director Since 2019 Callon Committees:

Audit, Strategic Planning and Reserves Other Current Directorships:

Camden Property Trust; Era Group Inc.; Oceaneering International, Inc. | |

Class III Directors | | | | | | Major General (Ret.) Barbara J. Faulkenberry | | Major General (Ret.) of the U.S. Air Force | | Barbara Faulkenberry has served as a member of the Board since 2018. Ms. Faulkenberry retired from the U.S. Air Force in 2014 as a Major General (2-stars) after a 32-year career, finishing in the top 150 leaders of a 320,000-person global organization. Her last assignment was as Vice Commander (COO) and interim Commander (CEO) of a 37,000-person organization conducting all global Department of Defense air cargo, passenger, and medical patient movements with 1,100 military aircraft plus contracted commercial aircraft. Ms. Faulkenberry is currently an independent director for USA Truck, a publicly-traded provider of logistics and trucking services across North America, where she serves as chair of the Technology Committee and as a member of the Nominating and Corporate Governance Committee. Ms. Faulkenberry received a B.S. degree from the Air Force Academy in 1982, an M.B.A. from Georgia College in 1986, and a Master of National Security from the National Defense University in 1999. She has also attended strategic leadership courses at Harvard, Cambridge, and Syracuse Universities. SKILLS AND QUALIFICATIONS: Ms. Faulkenberry brings to the Company senior leadership experience in the areas of supply chain management, logistics, strategic planning, risk management, technology, cyber security, and leadership development. Additionally, she is a NACD Board Leadership Fellow and earned the Carnegie Mellon/NACD CERT Certificate in Cybersecurity Oversight, both of which contribute to best practices in corporate governance and cyber security and provide great value to the Board. | INDEPENDENT Age 60 Director Since 2018 Callon Committees: Audit, Nominating and Corporate Governance, Strategic Planning and Reserves Other Current Directorships:

USA Truck, Inc. | |

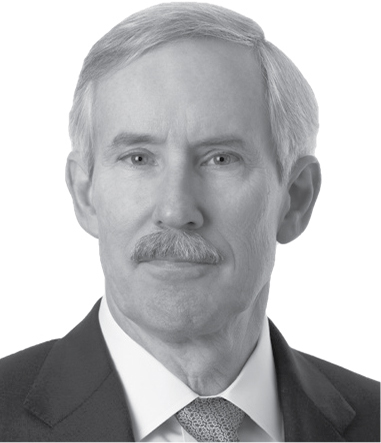

| | | | | | L. Richard Flury | | Chairman of the Board

Former Chief Executive (Retired) for Gas, Power & Renewables of BP plc | | Richard Flury has served as a member of the Board since 2004 and has served as Chairman since 2017. He spent over 30 years with Amoco Corporation, and later, BP plc, from which he retired as Chief Executive for Gas and Power and Renewables in 2001. Prior to Amoco’s merger with BP in 1998, he served in various executive positions and was Chief Executive for Worldwide Exploration and Production and Executive Vice President of Amoco Corporation at the time of the merger. Mr. Flury is a director of McDermott International, a publicly-traded engineering, procurement and construction company, including when it filed voluntary petitions for reorganization in the United States Bankruptcy Court for the Southern District of Texas in January 2020. Mr. Flury was a director and the non-executive Chairman of Chicago Bridge and Iron Company, N.V., a publicly-traded engineering, procurement and construction company, until it merged into McDermott International in 2018. Previously, Mr. Flury was a member of the Board of QEP Resources, Inc., a publicly-traded oil and gas exploration company, from 2010 to 2015. He is a graduate of the University of Victoria (Canada) where he studied geology. SKILLS AND QUALIFICATIONS: Mr. Flury’s deep knowledge of the energy industry and years of executive and management experience provide him with valuable insights into the strategic issues affecting companies in the oil and gas industry that are helpful to our Company and Board. His service on the boards of other publicly-traded companies has provided him exposure to different industries and approaches to governance that we believe further enhances the Board. | INDEPENDENT Age 72 Director Since 2004 Callon Committees:

Audit, Compensation, Strategic Planning and Reserves Other Current Directorships:

McDermott International | |

| | | | | | Joseph C. Gatto, Jr. | | President, Chief Executive Officer and Director | | Joseph C. Gatto, Jr. is President, Chief Executive Officer and Director of Callon. Mr. Gatto was elected to the Board in 2018. He has served as the Company's CEO since 2017 and as President since 2016. Prior to his appointment as CEO, he served as Chief Financial Officer and Treasurer of the Company from 2014 to 2017, and held various other senior leadership positions within the Company since joining Callon in 2012. Prior to joining the Company, Mr. Gatto served as Head of Structuring and Execution with Merrill Lynch Commodities from 2010 to 2011, as the founder of MarchWire Capital, LLC, a financial advisory and strategic consulting firm in 2009, and as a Managing Director in the energy investment banking groups of Merrill Lynch & Co. and Barclays Capital from 1997 to 2009. Mr. Gatto graduated from Cornell University with a B.S. degree and The Wharton School of the University of Pennsylvania with an M.B.A. SKILLS AND QUALIFICATIONS: Mr. Gatto’s extensive experience in investment banking and the oil and gas industry make him a valuable addition to the Board. Additionally, Mr. Gatto's knowledge of the Company and strong background in capital markets, transactions, strategic planning, and investor relations provide the Board with essential insight and guidance. | Age 49 Director Since 2018 | |

| | | | | | Frances Aldrich Sevilla-Sacasa | | Former Chief Executive Officer of Banco Itaú International | | Ms. Aldrich Sevilla-Sacasa is a private investor and was Chief Executive Officer of Banco Itaú International, Miami, Florida, from April 2012 to December 2016. Prior to that time, she served as Executive Advisor to the Dean of the University of Miami School of Business from 2011 to 2012, Interim Dean of the University of Miami School of Business from 2011 to 2011, President of U.S. Trust, Bank of America Private Wealth Management from 2007 to 2008, President and Chief Executive Officer of US Trust Company in 2007, and President of US Trust Company from November 2005 until June 2007. She previously served in a variety of roles with Citigroup’s private banking business, including President of Latin America Private Banking, President of Europe Private Banking, and Head of International Trust Business. Ms. Aldrich Sevilla-Sacasa holds a Bachelor of Arts Degree from the University of Miami and an M.B.A. from the Thunderbird School of Global Management. SKILLS AND QUALIFICATIONS: Ms. Aldrich Sevilla-Sacasa brings to the Board considerable experience in financial services, banking and wealth management. In addition, her experience as a former president and chief executive officer of a trust and wealth management company, and as a director of other corporate and not-for-profit boards has provided her with expertise in the area of corporate governance. | Age 64 Director Since 2019 Callon Committees:

Nominating and Corporate Governance; Strategic Planning and Reserves Other Current Directorships:

Camden Property Trust | |

Current Composition of the Board The following table provides information with respect to the skills and experience of all current directors and the nominees for Class II terms who have been nominated to stand for election at the Annual Meeting. | | | | | | | | | | | | | | | Name | Matthew R. Bob | Barbara J. Faulkenberry | Michael L. Finch | L. Richard Flury (Chairman) | Joseph C. Gatto, Jr. | S.P. Johnson IV | Larry D. McVay | Anthony J. Nocchiero | Frances A. Sevilla-Sacasa | James M. Trimble | Steven A. Webster | | Age (as of April 1, 2020) | 63 | 60 | 64 | 72 | 49 | 64 | 72 | 69 | 64 | 71 | 68 | | Tenure (as of April 1, 2020) | 6 | 2 | 5 | 16 | 2 | 1 | 13 | 9 | 1 | 6 | 1 | | Gender Diversity | | ● | | | | | | | ● | | | | CEO/President Experience | ● | | | ● | ● | ● | | | ● | ● | ● | | Senior Executive Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | | Outside Public Boards (current) | ● | ● | | ● | | | ● | | ● | ● | ● | | Outside Public Boards (prior) | | | ● | ● | | ● | ● | ● | | ● | ● | | E&P Industry Experience | ● | | ● | ● | ● | ● | ● | ● | | ● | ● | | Energy (Other than E&P) Industry Experience | ● | | ● | ● | ● | | ● | ● | | | ● | | Financial Expert | | | ● | | | | | ● | ● | | | | Financial Literacy | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | | Financial Oversight/Accounting | | | ● | ● | ● | ● | ● | ● | ● | ● | ● | | Petroleum and Other Engineering | | | | | | ● | ● | ● | | ● | | | Geologist or Geophysicist | ● | | | ● | | | | | | | | | Government/Public Policy/Regulatory | | ● | | | | | ● | | | | | | HES Experience/Environmental | | | | | | ● | ● | | | ● | | | Strategic Advising | | ● | | ● | ● | ● | ● | ● | ● | ● | ● | | Investment Banking | | | | | ● | | | | ● | | | | Supply Chain | | ● | | | | | ● | | | | | | Technology/IT/Cybersecurity | | ● | | | | | ● | ● | | ● | |

Director Compensation The compensation policies and practices promote a performance-based culture and align our executives’ interests with those of our stockholders throughnon-employee directors is reviewed by the Compensation Committee and is approved by the Board. We use a strong emphasiscombination of cash and stock-based incentive compensation to attract and retain qualified candidates to serve on at-riskthe Board. In determining director compensation, tiedwe consider the responsibilities of our directors, the significant amount of time the directors spend fulfilling their duties, and the competitive market for skilled directors. Annually the Compensation Committee directly engages Meridian Compensation Partners ("Meridian") to conduct an analysis of director compensation and recommend any adjustments to the achievementtotal annual compensation of performance objectives and the creationnon-employee directors. Specifically, Meridian evaluates competitive market data, utilizing the same industry peer group ("Peer Group") used for executive compensation market data (see page 42). The Compensation Committee generally targets total compensation near the median of stockholder value. In this Proxy Statement, you will find a discussion of our pay-for-performancePeer Group. The Company's director compensation program structuredgenerally consists of cash retainers and an annual grant of restricted stock units ("RSUs") awarded under the Company’s 2018 Omnibus Incentive Plan (the “2018 Plan”). The RSU grants are awarded to align executive paymatch competitive practices and encourage a long-term alignment with Company performance, stockholder expectationsshareholders. In March 2019, with input from compensation advisor Meridian, the Compensation Committee reviewed the competitiveness of the director compensation package. Upon recommendation from the Compensation Committee, the Board determined to maintain compensation levels established in 2018, maintaining both an annual cash retainer of $80,000 and prevailing market practices. Key actions in 2017 includedan annual restricted stock unit grant of $165,000. The average total compensation for Callon directors is at approximately the median of the Peer Group. For 2019, the Company's non-employee director compensation consisted of the following: With the sudden passing of our long-time CEO | | | | | | Board member cash retainer | $ | 80,000 |

| | Restricted Stock Unit (RSU) Grant Value | $ | 165,000 |

| | Chairmen Fees | | | Non-Executive Chair | $ | 120,000 |

| | Audit Committee Chair | $ | 20,000 |

| | Compensation Committee Chair | $ | 15,000 |

| | Nominating and Corporative Governance Committee Chair | $ | 10,000 |

| | Strategic Planning and Reserves Committee Chair | $ | 10,000 |

|

Each non-employee director is reimbursed for reasonable out-of-pocket costs incurred to attend Board and ChairmanCommittee meetings. If a member of the Board Fred L.is an officer or employee of the Company, he or she does not receive compensation for his or her service as a director. The RSUs granted to directors in 2019 will vest on the first anniversary date following the grant, or on the date of the Company’s Annual Meeting , whichever occurs first. Directors have the opportunity to make an annual election to defer some or all of their cash retainer or annual stock award pursuant to the terms of a deferred compensation plan for non-employee directors (the "Deferred Compensation Plan") until separation from service as a director. All deferrals under the plan are credited as phantom stock units of Callon in May 2017,stock. Callon's directors are subject to stock ownership guidelines of five times the Board approvedannual cash retainer of $80,000. For more information on the promotionstock ownership guidelines, see page 49.

The table below indicates the total compensation earned during 2019 for each non-employee director: | NON-EMPLOYEE DIRECTOR COMPENSATION FOR 2019 | | | | | | | | | | | | | | | | Director | Fees Earned or Paid in Cash(a) | | Stock Awards(b) | | All Other Compensation | | Total | | Matthew R. Bob | $ | 95,000 |

| (c) | $ | 165,000 |

|

| $0 | | $ | 260,000 |

| | Barbara J. Faulkenberry | $ | 80,000 |

| (d) | $ | 165,000 |

| | $0 | | $ | 245,000 |

| | Michael L. Finch | $ | 80,000 |

| (d) | $ | 165,000 |

| | $0 | | $ | 245,000 |

| | L. Richard Flury | $ | 200,000 |

| (e) | $ | 165,000 |

| | $0 | | $ | 365,000 |

| S. P. Johnson IV(i) | $ | 0 |

| | $ | 0 |

| | $0 | | $ | 0 |

| | Larry D. McVay | $ | 90,000 |

| (f) | $ | 165,000 |

| | $0 | | $ | 255,000 |

| | Anthony J. Nocchiero | $ | 100,000 |

| (g) | $ | 165,000 |

| | $0 | | $ | 265,000 |

| Frances Aldrich Sevilla-Sacasa(i) | $ | 0 |

| | $ | 0 |

| | $0 | | $ | 0 |

| | James M. Trimble | $ | 90,000 |

| (h) | $ | 165,000 |

| | $0 | | $ | 255,000 |

| Steven A. Webster(i) | $ | 0 |

| | $ | 0 |

| | $0 | | $ | 0 |

|

| | (a) | Does not include reimbursement of expenses associated with attending Board and Committee meetings. |

| | (b) | Amounts calculated utilizing the provisions of FASB ASC Topic 718. These amounts are equal to the grant date fair value of the awards. The aggregate number of stock unit awards outstanding as of December 31, 2019 for each director is as follows: Messrs. Bob, Flinch, Flury, McVay, Nocchiero and Trimble - 24,076; Ms. Faulkenberry - 20,370; Messrs. Johnson and Webster - 0; and Ms. Sevilla-Sacasa - 0. |

| | (c) | Represents annual retainer of $80,000 and an additional $15,000 for acting as Chairman of the Compensation Committee. |

| | (d) | Represents annual retainer of $80,000. |

| | (e) | Represents annual retainer of $80,000 and an additional $120,000 for acting as the non-executive Chairman of the Board. Mr. Flury elected to have his annual retainer and his non-executive Chairman of the Board fees deferred pursuant to the terms of the Deferred Compensation Plan , under which participants may elect to convert cash fees earned to phantom shares and defer the receipt of the proceeds in cash until separation from service as a director. |

| | (f) | Represents annual retainer of $80,000 and an additional $10,000 for acting as Chairman of the Strategic Planning and Reserves Committee. |

| | (g) | Represents annual retainer of $80,000 and an additional $20,000 for acting as Chairman of the Audit Committee. |

| | (h) | Represents annual retainer of $80,000 and an additional $10,000 for acting as Chairman of the Nominating and Corporate Governance Committee. |

| | (i) | Messrs. Johnson and Webster and Ms. Sevilla-Sacasa were not members of Callon's Board prior to December 20, 2019. Amounts shown for Messrs. Johnson and Webster and Ms. Sevilla-Sacasa represent compensation paid by Callon following the Carrizo Acquisition. |

Pursuant to the terms of Joseph C. Gatto, Jr., previously President and Chief Financial Officer (“CFO”), to CEO,the Merger Agreement and the Compensation Committee increased salariesCarrizo Change in Control Severance Plan, during 2020 the Company will pay to Mr. Johnson $4,146,000 in severance benefits and granted restricted stock unit (“RSUs”) awards for Mr. Gatto and Chief Operating Officer (“COO”) Gary Newberry commensurate with their expanded responsibilities; As a result2019 annual bonus of $670,175. For more information about the achievements detailed above and in the Compensation Discussion and Analysis (“CD&A”) section, the Compensation Committee awarded bonuses above target for our NEOs for 2017 performance;

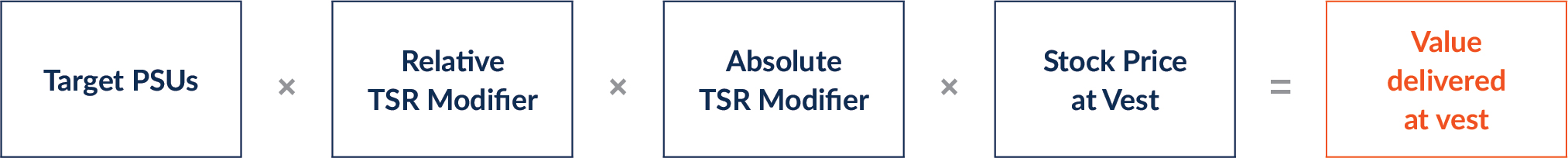

The Compensation Committee granted long-term incentives to our NEOs, 60% of which were tied to our Total Stockholder Return (“TSR”); and

The Compensation Committee certified the results of the 2015 grants of performance-based stock units (“PSUs”), which measured our TSR against certain of our peers for the 2015 to 2017 time period, ranking third out of 13 peers, resulting in 183% of the targeted number of PSUs vesting.

Approximately 96% of the shares voted at our 2017 Annual Meeting approved our 2016 executive compensation by supporting our “say-on-pay” proposal.

2019 Carrizo annual bonus payout, please see page 46.

Key ElementsDirector Independence

To minimize potential conflicts, it is a policy of Our Executive Compensationthe Board that a majority of the Board be independent. In accordance with the standards for companies listed on the New York Stock Exchange ("NYSE") and the rules and regulations promulgated by the SEC, as well as our Corporate Governance Guidelines, the Board considers a director to be independent if it has affirmatively determined that the director has no material relationship with the Company that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. The Board revisits the independence of each director on an annual basis and makes independence determinations when a newly appointed director joins the Board between annual meetings. The Board reviewed the independence of its directors and nominees in accordance with the standards described above and affirmatively determined that each of the directors (other than Mr. Gatto) and nominees is independent.

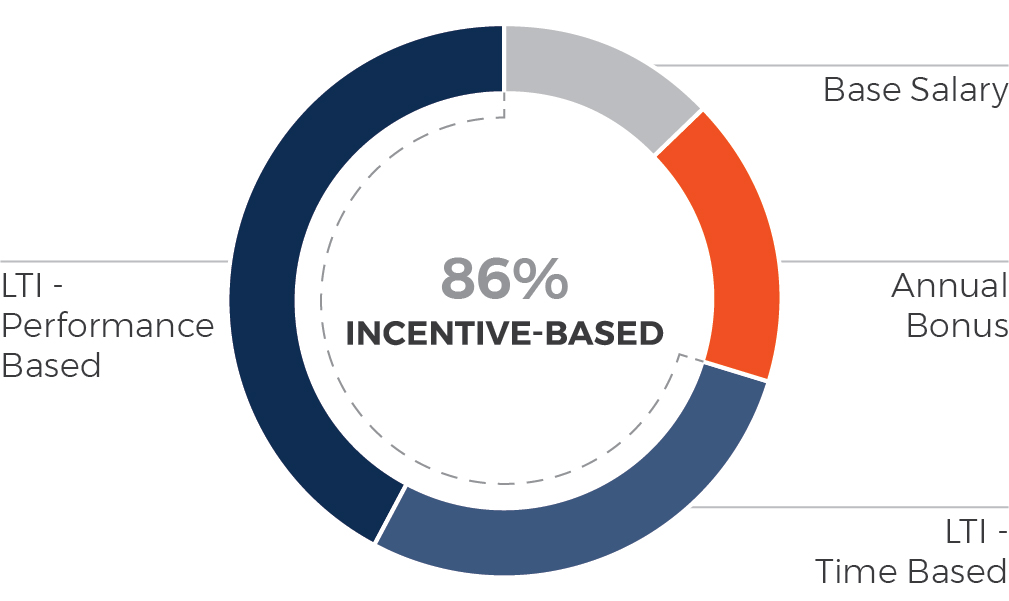

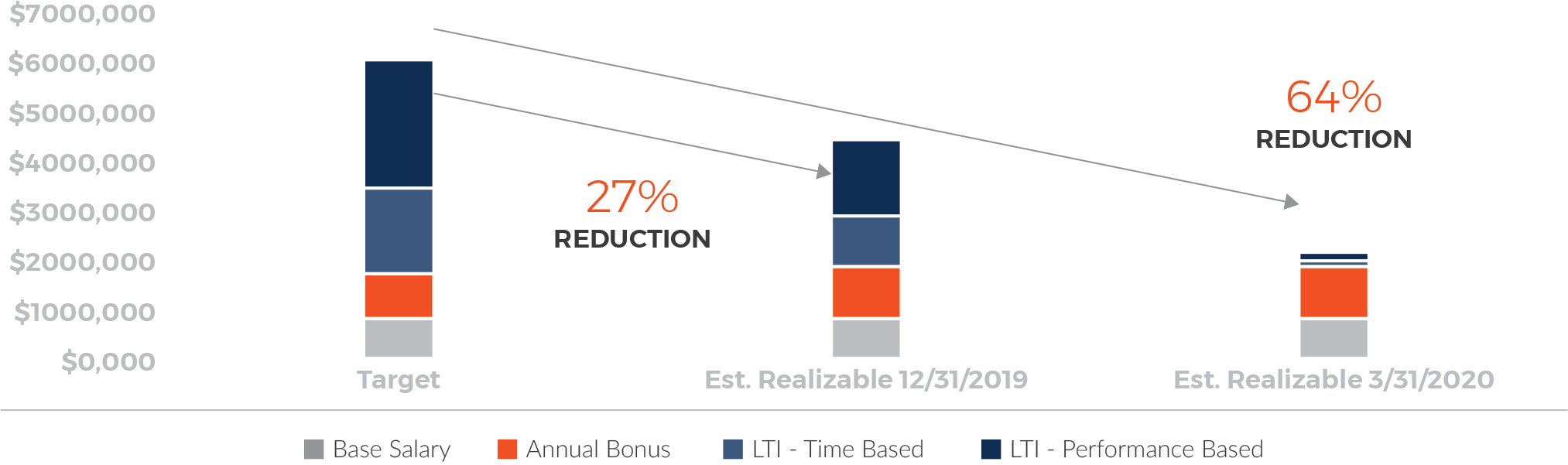

“Pay-for-Performance” philosophy linking incentive compensation directly to performance, with a significant portion of total annual compensation placed “at risk”

Competitive base salary2020 PROXY STATEMENT21

Annual cash bonus incentive tied to the achievement of Company performance objectives

Long-term equity-based incentive awards, including time-based RSUs and a PSU program based on relative TSRCORPORATE GOVERNANCE

Carefully considered performance metrics that do not encourage excessive risk-taking

Balanced consideration of internal pay parity, external competitiveness and performance results

Competitive benefit plans and programs in line with our overall employee population, including retirement and health benefits, and change in control severance protection, but no significant perquisites.

Board Structure and Responsibilities Governance HighlightsMajority Vote Standard

We are committed to effective and sustainable corporate governance, which we believe strengthens Board and management accountability, promotes the long-term interests of our stockholders and helps build public trust in our Company. We continually assess our core values and governance principles to ensure that we operate our business responsibly, ethically and in a manner aligned with the interests of our stockholders. Highlights of our commitment to strong corporate governance include the following:

Board: Six meetings in 2017

| | ▪ | Compensation: Five meetings |

| | ▪ | Nominating and Corporate Governance: Six meetings |

| | ▪ | Strategic Planning and Reserves: Three meetings |

All seven of the current directors are independent, and if the nominated directors are elected, then seven out of eight directors will be independent

All committees are comprised entirely of independent directors

Appointed an independent, non-executive director as Chairman of the Board

Paced refreshment of the Board; following the 2018 Annual Meeting, if the nominated directors are elected, five of the eight directors will have joined within the last five years

Board includes a balance of experience, tenure and qualifications in areas important to our business

Overboarding policy in place for directors

Regular executive sessions of independent directors

Updated all governance documents, including all committee charters, the Code of Business Conduct and Ethics, and theOur Corporate Governance Guidelines provide for a majority voting policy in uncontested director elections. The Company believes that the majority vote standard ensures accountability and the opportunity for a positive mandate from the Company’s shareholders. At any shareholder meeting for the election of directors at which increased focus ona quorum is present, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” such election (“Majority Withheld Vote”) shall tender his or her resignation for consideration by the compositionNominating and Corporate Governance Committee following certification of the shareholder vote, unless the number of nominees exceeds the number of directors to be elected as of the Record Date for such meeting, in which event the directors shall be elected by a plurality of the votes cast. Such resignation will only be effective upon Board acceptance of such resignation after receiving the recommendation of the Nominating and Corporate Governance Committee.

If a director nominee receives a Majority Withheld Vote, then promptly following the certification of the election results, the Nominating and Corporate Governance Committee will consider any factors it deems relevant to the best interests of the Company and our shareholders in determining whether to accept the director’s resignation and recommend to the Board that action to be taken with respect to the tendered resignation. Within 120 days following certification of the shareholder vote, the Board shall consider the recommendation and make a determination as to whether to accept or reject such director’s resignation and shall notify the director concerned of its decision. We will also promptly publicly disclose the Board’s decision and process in a periodic or current report filed with or furnished to the SEC. If you hold your shares through a broker and you do not instruct the broker how to vote, your broker will not have the authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum but will have no effect upon the outcome of the vote. All shares of common stock represented by proxies will be voted “FOR” the election of the director nominees, except where authority to vote in the election of directors has been withheld. Should the nominees become unable or unwilling to serve as a director at the time of the Annual Meeting, the person or persons exercising the proxies will vote for the election of substitute nominees designated by the Board, or the Board may choose to reduce the number of members of the Board andto be elected at the Annual Meeting in order to eliminate the vacancy. Your proxy cannot be otherwise voted for a person who is not named in this Proxy Statement as a candidate for director selection process, including emphasis on diversity, as reflected inor for a greater number of persons than the number of director nominees named. The Board has no reason to believe that the nominees for this Annual Meeting Conduct annual Board and committee self-evaluations

Annual Say-On-Pay voting

Majority vote standard for uncontested director elections

Significant director and executive officer stock ownership guidelines

Regular succession planning

Independent executive compensation consultant reportingwill be unable or unwilling to the Compensation Committee

No employment agreements with NEOs

No excise or other tax gross-ups in our compensation plans

Double-trigger change-in-control provisions in our severance agreements and equity awards

No Poison Pill (Stockholder Rights Plan)

Stringent insider trading, anti-hedging and anti-pledging policies

Active stockholder engagement practices

serve if elected.

| | | | PROPOSAL 1 - ELECTION OF DIRECTORSThe Board recommends a vote FOR each of the three Class II director nominees. | |

Directors Nominated For Re-Election The Board currently consists of seven directors, andeleven directors. Consistent with our Certificatecertificate of Incorporation provides for a classified Board. Theincorporation, the current Board is divided into three classes designated as Class I, Class II, and Class III, each with staggered, three-year terms. The following table provides information with respect to all current directors and the nominees for Class III terms who have been nominated for election at the 2018 Annual Meeting. | | | | | | | | | | | | | | | | | | | | | Position (Committee Memberships) | | Name | | Age | | Director Since | | Audit | | Compensation | | Nominating and Corporate Governance | | Strategic Planning and Reserves | Class I Directors (a) | | | | | | | | | | | | | | Michael L. Finch | | 62 | | 2015 | | ü | | | | ü | | ü | | Larry D. McVay | | 70 | | 2007 | | ü | | | | ü | | Chair | John C. Wallace (b) | | 79 | | 1994 | | Chair | | ü | | | | ü | Class II Directors (c) | | | | | | | | | | | | | | Matthew R. Bob | | 60 | | 2014 | | | | Chair | | ü | | ü | | Anthony J. Nocchiero | | 66 | | 2011 | | ü | | ü | | Chair | | ü | | James M. Trimble | | 69 | | 2014 | | | | ü | | ü | | ü | Class III Directors (d) | | | | | | | | | | | | | Barbara J. Faulkenberry (e) | | 58 | | | | | | | | | | | L. Richard Flury (e)(f) | | 70 | | 2004 | | ü | | ü | | | | ü | Joseph C. Gatto, Jr. (e) | | 47 | | | | | | | | | | |

| | (d) | If elected, term will expire in 2021. |

| | (f) | Chairman of the Board. |

Based on the recommendations from the Nominating and Corporate Governance Committee, ourthe Board has nominated onethree continuing Class III Director, L. Richard Flury,II Directors, Messrs. Matthew R. Bob, Anthony J. Nocchiero and James M. Trimble, to stand for re-election and two new nominees, Barbara J. Faulkenberry, a retired two-star Air Force General, and Joseph C. Gatto, Jr., the Company’s President and CEO, to stand for election to the Board for a three-year term expiring at our 2021 Annual Meeting, or, in each case, until the election and qualification of their respective successors or until their earlier death, retirement, resignation or removal. Mr. Wallace has informed the Board of his intent to retire upon the close of 2018 Annual Meeting. Following this retirement, Class I will be made up of two directors.

Director Nominees

The following biographies reflect the particular experience, qualifications, attributes, and skills that led the Board to conclude that each nominee should stand for re-election to serve on the Board: Class II Directors | | | | | | Matthew R. Bob | | President of Eagle Oil and Gas; Managing Member of MB Exploration | | Matthew Bob has served as a member of the Board since 2014. Mr. Bob currently serves as President of Eagle Oil and Gas and has been the founder and managing member of MB Exploration and affiliated companies since 1994. Previously, Mr. Bob served as President of Hall Phoenix Energy LLC, a privately held oil and gas exploration company, from 2009 to 2011. Prior to forming MB Exploration, Mr. Bob was Chief Geophysicist at Pitts Oil Company. He began his career at Union Oil Company of California where he held various geological positions. Mr. Bob currently serves as an independent director of Southcross Energy, a natural gas processing and transportation company with operations in South Texas. Mr. Bob holds a B.A. in Geology from St. Louis University and an M.S. in Geology from Memphis University, and is a graduate of Harvard University’s Executive Management Program. He is a member of the American Association of Petroleum Geologists, the Society of Exploration Geophysicists and the Dallas Petroleum Club, and is a registered Geoscientist in the States of Texas, Mississippi and Louisiana. SKILLS AND QUALIFICATIONS: Mr. Bob’s extensive knowledge of the exploration and production industry and technical expertise are assets to the Board and qualify him as a director. His experience as a senior executive further strengthens the strategic and oversight functions of the Board. | INDEPENDENT Age 63 Director Since 2014 Callon Committees:

Compensation (Chairman), Nominating and Corporate Governance, Strategic Planning and Reserves Other Current Directorships:

Southcross Energy | |

| | | | | | Anthony J. Nocchiero | | Former SVP and Chief Financial Officer (Retired) of CF Industries, Inc. | | Anthony Nocchiero has served as a member of the Board since 2011. Mr. Nocchiero retired as Senior Vice President and Chief Financial Officer for CF Industries, Inc. in 2010, a position he had held since 2007. From 2005 to 2007, he was the Vice President and Chief Financial Officer for Merisant Worldwide, Inc. Prior to that, Mr. Nocchiero was self-employed as an advisor and private consultant from 2002 to 2005. From 1999 to 2001, Mr. Nocchiero served as Vice President and CFO of BP Chemicals, the global petrochemical business of BP plc. Prior to that, he spent 24 years with Amoco Corporation in various financial and management positions, including service as Amoco’s Vice President and Controller from 1998 to 1999. Mr. Nocchiero has previous experience serving as a board member of various public and private companies, including Terra Nitrogen LP, Keytrade AG, Vysis Corporation and the Chicago Chamber of Commerce. Mr. Nocchiero holds a B.S. degree in Chemical Engineering from Washington University in St. Louis and an M.B.A. degree from the Kellogg Graduate School of Management at Northwestern University. SKILLS AND QUALIFICATIONS: Mr. Nocchiero’s broad financial, accounting and operating experience within the energy industry are valuable to the Board and make him a meaningful contributor as a director. Additionally, Mr. Nocchiero’s status as a “financial expert” and knowledge of public company reporting requirements add meaningful insights to the Board and Audit Committee. | INDEPENDENT Age 69 Director Since 2011 Callon Committees:

Audit (Chairman), Compensation, Strategic Planning and Reserves | |

| | | | | | James M. Trimble | | Former Chief Executive Officer and President (Retired) of Stone Energy Corporation | | James Trimble has served as a member of the Board since 2014. Most recently, Mr. Trimble served as the interim Chief Executive Officer and President of Stone Energy Corporation from 2017 to 2018. Prior to that, Mr. Trimble served as CEO and President of PDC Energy, Inc. from 2011 until his retirement in 2015. Mr. Trimble was Managing Director of Grand Gulf Energy Limited, a public company traded on the Australian Securities Exchange, and President and CEO of Grand Gulf’s U.S. subsidiary Grand Gulf Energy Company LLC, an exploration and development company focused primarily on drilling in mature basins in Texas, Louisiana and Oklahoma, from 2005 to 2010. Earlier in his career, Mr. Trimble was CEO of TexCal (formerly Tri-Union Development) and CEO of Elysium Energy, a privately held oil and gas exploration company. Prior to that, he was Senior Vice President of Exploration and Production for Cabot Oil and Gas, a publicly-traded independent energy company. Mr. Trimble currently serves as a director of Talos Energy, a publicly-traded oil and gas exploration company, and Chairman of the Board of Crestone Peak Resources LLC, a privately held oil and gas exploration company. Previously, Mr. Trimble was a director of Stone Energy Corporation from 2017 to 2018, PDC Energy from 2009 to 2016, C&J Energy Services from 2016 to 2017, Seisgen Exploration from 2008 to 2015, Grand Gulf Energy from 2009 to 2012, and Blue Dolphin Energy from 2002 to 2006. Mr. Trimble was an officer of PDC Energy in September 2013, when each of the twelve partnerships for which the company was the managing general partner filed for bankruptcy in the federal bankruptcy court, Northern District of Texas, Dallas Division and was on the board of C&J Energy Services when it filed for bankruptcy in the court of the Southern District of Texas, Houston Division in July 2016. Mr. Trimble graduated from Mississippi State University where he majored in petroleum engineering for undergraduate (Bachelor of Science) and graduate studies. He is a Registered Professional Engineer in the State of Texas. SKILLS AND QUALIFICATIONS: Mr. Trimble’s deep knowledge of the exploration and production industry and his leadership experience at previous companies strengthen the strategic and oversight functions of the Board. His experience on the boards of several other public companies provide valuable perspective on best practices relating to corporate governance, management and strategic transactions. | INDEPENDENT Age 71 Director Since 2014 Callon Committees:

Nominating and Corporate Governance (Chairman), Compensation, Strategic Planning and Reserves Other Current Directorships:

Talos Energy | |

CORPORATE GOVERNANCE Directors Continuing in Office Biographical information for our directors continuing in office is set forth below. These individuals are not standing for re-election at this time: Class I Directors | | | | | | Michael L. Finch | | Former Chief Financial Officer (Retired) of Stone Energy Corporation | | Michael Finch has served as a member of the Board since 2015. He spent nearly 20 years affiliated with Stone Energy Corporation, a publicly-traded oil and gas exploration company, from which he retired as Chief Financial Officer and a member of the Board of Directors in 1999. Prior to his service with Stone Energy, he was employed by Arthur Andersen & Co. Mr. Finch was an independent director of Petroquest Energy, Inc. a publicly-traded oil and gas company, from 2003 to 2016, where he served as chairman of the Audit Committee and as a member of the Compensation Committee and the Nominating and Corporate Governance Committee. Mr. Finch currently serves on the advisory board of C.H. Fenstermaker & Associates, a multi-disciplinary consulting firm that specializes in surveying and mapping, engineering and environmental consulting. Mr. Finch holds a B.S. in Accounting from the University of South Alabama and was licensed as a Certified Public Accountant (currently inactive). SKILLS AND QUALIFICATIONS: Mr. Finch’s extensive financial, accounting, and operating experience within the oil and gas industry are extremely valuable to the Board and qualify him as a director. In particular, Mr. Finch’s accounting background and status as a “financial expert” provide the Board valuable perspective on issues facing audit committees. | INDEPENDENT Age 64 Director Since 2015 Callon Committees:

Audit, Compensation, Strategic Planning and Reserves | |